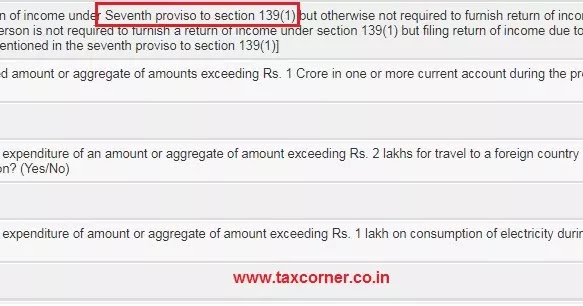

OPTOTAX - #optotaxitupdates #Extension of #DueDates under #IncomeTax ✓ Filing of Belated Return under Section 139(4) for AY 2020-21 has been Extended to 31st May, 2021 ✓ Return filed in response to

Part III Administrative, Procedural, and Miscellaneous 26 CFR 1.6012-1: Individuals required to make returns of income. (Also: